The cannabis industry continues to experience significant growth. It impacts various sectors in the United States and globally. The transition of cannabis from a stigmatized substance to a lucrative industry results from changing legal landscapes and public perception. This article provides an analytical insight into the cannabis industry’s market size, legislative changes, employment opportunities, and economic impact. Dive into a detailed exploration of cannabis industry statistics as it stands in 2023.

Cannabis Statistics: Market Size and Value

As the cannabis industry continues to flourish, understanding the market size and value is pivotal for stakeholders and prospective entrants.

The cannabis industry’s upward trajectory continues to be of keen interest to stakeholders and individuals considering entering this market. By the end of 2023, the US market is anticipated to hit $32.9 billion1, making it a dominant player in cannabis revenue generation compared to other countries.

Notably, the sector is on track to pump an estimated $100 billion into the US economy in 2023, showcasing its substantial economic footprint. In parallel, the global cannabis cultivation market was valued at USD 392.1 billion in 2022. It’s expected to expand at a compound annual growth rate (CAGR) of 21.3% from 2023 to 2030.2

These figures highlight the industry’s robust growth trajectory and paint a promising picture for both existing and prospective market players. The leading cannabis statistics in market value and favorable growth rate underscore a thriving and lucrative industry backdrop. The cannabis industry is a fertile industry for expansion and enhanced profitability for both existing stakeholders and new entrants.

Cannabis Industry Data Indicators

Some key cannabis industry market size statistics:

- The US market size is projected to reach $32.9 billion by the end of 2023, leading in cannabis revenue generation globally.3

- An estimated $100 billion contribution to the US economy is expected from the cannabis industry in 2023.4

- Global market expansion from $133 billion in 2022 to $155 billion in 2023, showcasing a CAGR of 16.6%5

Cultivation Sector

In 2023, the cultivation sector has grown substantially to become a cornerstone of the cannabis industry. The US cannabis statistics now hold the title for the largest cannabis cultivation market worldwide, with a value of $33.88 billion.6

Production

The production phase is pivotal in the cannabis industry, influencing both the market’s supply and quality standards. Adopting advanced cultivation techniques and technology propels higher yields and better-quality cannabis. The increased production aligns with the increasing demand and regulatory compliance.

Additionally, in 2023, the average cannabis cultivator in the US produces 1,000 pounds of cannabis per year. However, this figure varies state-wise. For instance, Colorado averages 1,500 pounds, Oregon 1,200 pounds, and Washington 1,100 pounds of cannabis annually.7

Production Volume

The global cannabis cultivation market grew from $133.49 billion in 2022 to $155.66 billion in 2023 at a compound annual growth rate (CAGR) of 16.6%.8

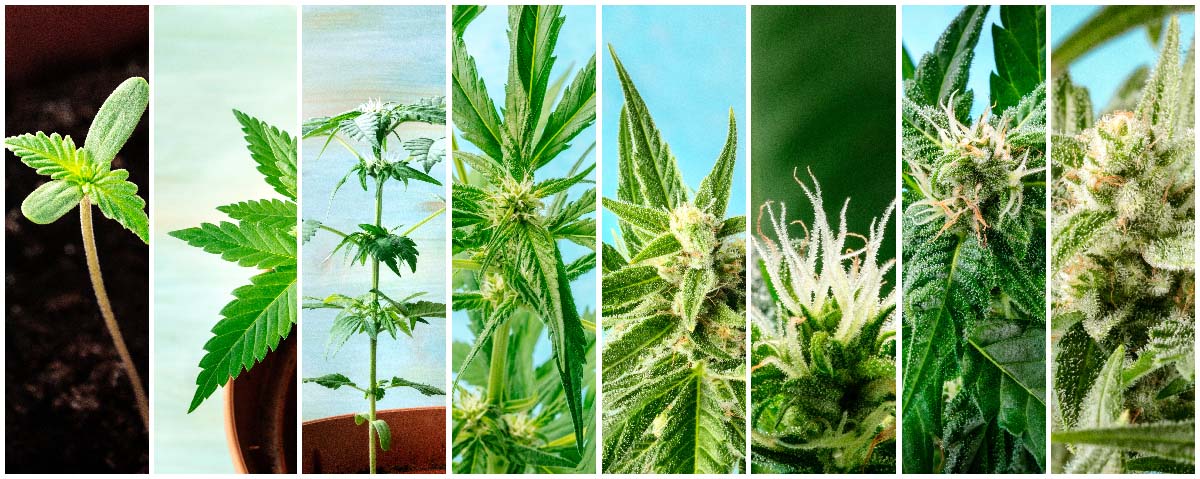

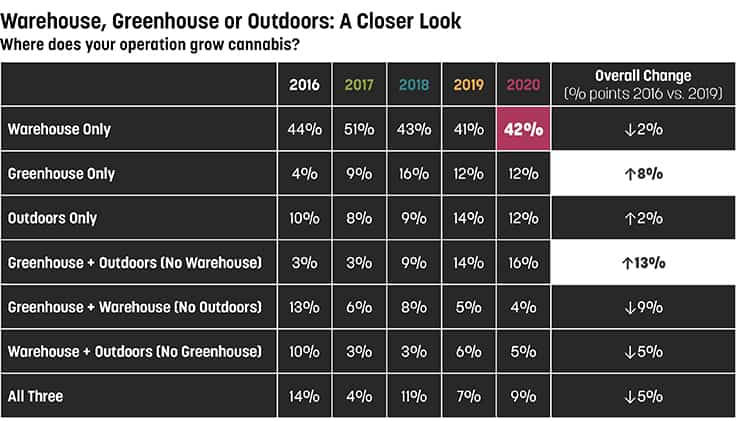

Indoor cultivation is the dominant mode of production. A Cannabis Business Times report found that 60 percent of cannabis was grown in warehouse (indoor) facilities in 2020.

As previously mentioned, in this chart, we can see an industry trend toward greenhouse and outdoor cultivation. One hypothesis is that compressing prices for cannabis material drives growers to decrease their cost of production. While indoor cultivation is costly due to equipment and environmental control investments, greenhouse cultivation can also produce high-quality product at a fraction of the price.

Key Production Figures

- As of late 2022, there were 13,297 active legal cannabis farms in the US.9

- Legal cannabis production totaled about 2,834 metric tons for Adult-Use marijuana in 2022.10

- The global cannabis cultivation market size is set to reach USD 1,844.1 billion, expanding at a CAGR of 21.3% from 2023 to 2030.11

Cultivation Licenses and Facilities

The landscape of cultivation licenses showcases a notable disparity across states, with California towering with 6,881 licenses in 2022, significantly overshadowing Oregon’s 1,406.12 The difference in regional regulatory frameworks and the concentration of cultivation activities in certain states explain the variance in the number of operators.

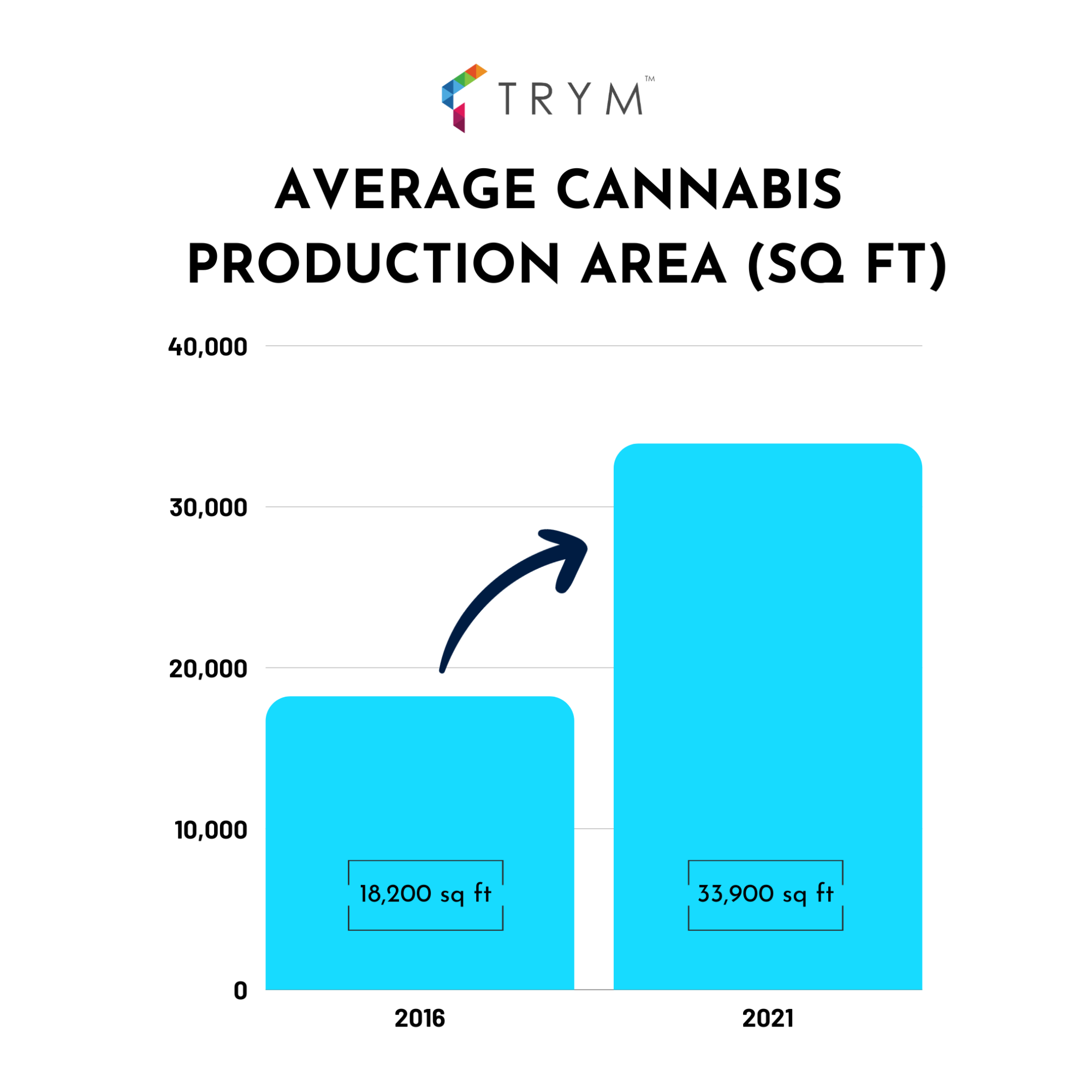

Over the years, a substantial expansion in cultivation facilities has occurred. The average cannabis production area grew from 18,200 sq. feet in 2016 to 33,900 sq. feet in 2021, marking an 86% increase.13 This expansion echoes the industry’s response to soaring demand and the endeavors to optimize production capacities.

A 2021 study highlighted that 54% of cultivators operated in indoor facilities. Known for its controlled environment, indoor farming signifies a strategic move towards enhancing quality and yield, underlining the industry’s shift towards more sophisticated and controlled cultivation practices.

Production Costs

The pursuit of reducing production costs while bolstering productivity and profitability remains a constant endeavor in the cannabis cultivation sector. Here’s a glimpse into some data points and trends observed in cultivation production costs and strategies employed by cultivators.

Cost Variance:

- The cost to produce a pound of cannabis can fluctuate significantly, spanning from about $150 to $1,000 depending on the location, climate, and cultivation efficiency.

Rising Labor Costs:

- Labor is a significant expenditure in cannabis cultivation, with hourly rates for harvest workers climbing to a range of $14-$25/hour, denoting a surge in labor costs.

Pricing, Sales, and Taxation

The fiscal narrative of the cannabis industry unfolds through the lens of retail taxes, sales tax revenue, and wholesale cannabis pricing.

California and Washington were the leading U.S. states in tax revenues collected from recreational marijuana sales in 2022. Tax revenues from cannabis sales reached over one billion U.S. dollars in the state of California, while the figure for Washington was around 529 million dollars.14

California ($774 million), Washington ($517 million), and Illinois ($466 million) had the highest total state tax revenue collected in 2022.15

- In 2022, nearly $3 billion in retail cannabis taxes were collected

- Average retail prices across mature markets (AZ, CA, CO, NV, OR) fell 13% between Q3 2021 and Q3 2022, with some markets seeing price compression higher than 20%.16

- Cannabis sales tax revenue on annual sales escalated 34% in 2021, accumulating over $3.7 billion.17

- As of October 2023, the wholesale price of cannabis in the US stood at $1,023 per pound.18

Legislation

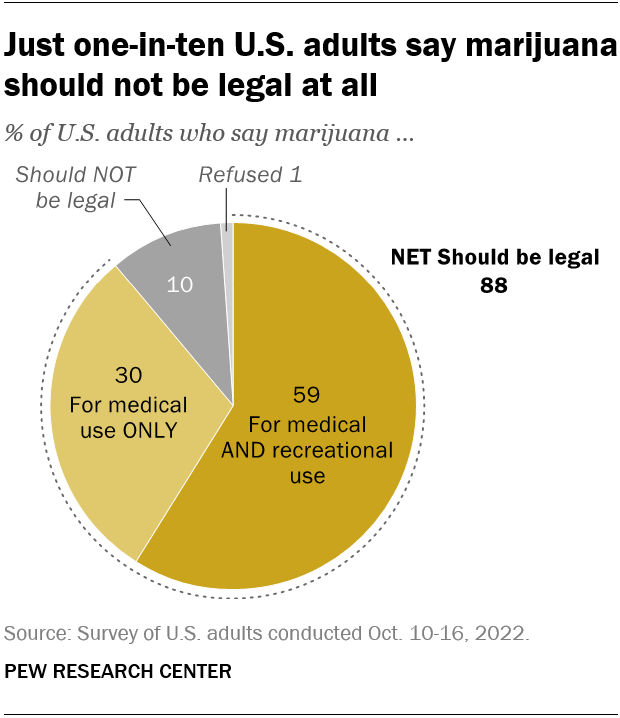

The landscape of cannabis legislation is gradually evolving, reflecting the public’s changing attitudes toward this plant. Currently, a substantial 88% of adults favor legalizing weed, potentially paving the way for more relaxed regulations in the near future. The development of legislative frameworks is expected to continue, accommodating the growing acceptance and understanding of medical cannabis and Adult-Use cannabis benefits.

Source: Pew Research Center

Economic Impact

The economic impact of the cannabis industry is burgeoning, with projections indicating a $100 billion injection into the US economy in 2023. This economic boost isn’t merely a direct result of medical and recreational cannabis sales, but a ripple effect that spreads across various sectors. For instance, for every $10 spent on cannabis, an additional $18 is projected to be channeled back into the economy, predominantly at the local level.

The growth trajectory doesn’t stop there; the economic impact is anticipated to leap by another 12.5% in 2024, and from 2023 to 2028, a whopping increment of 41% is expected.

Source: MJBiz

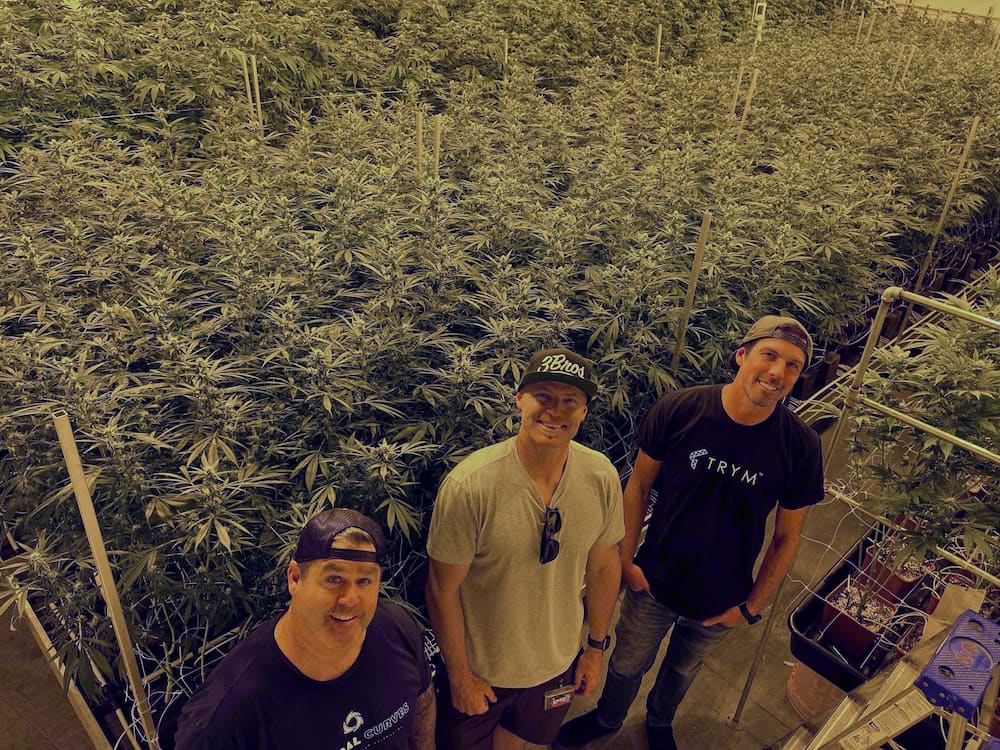

Cannabis Industry Data: Employment

The marijuana industry is blossoming into a significant job creator. As of January 2023, it’s estimated that 418,059 full-time equivalent positions exist within the US cannabis industry, with about 280 new jobs being added daily19. The employment trajectory within the cannabis sector showcases a promising trend, as more than 100,000 new jobs were established in the previous year, marking the cannabis industry as America’s fastest-growing job sector20.

Vangst’s recent report shows that marijuana businesses experienced a 75% increase in employment over the last two years. The cannabis industry currently employs over 400,000 workers. In cultivation, salaries ranged from trimmers and post-harvest workers who make from $14 to $22.50 per hour up to directors of cultivation earning from $85,000 up to $160,000 annually.21

The median salary in the marijuana industry was reported to be $58,511 in 2019, which was 10.7% higher than the US median salary, underscoring the promising cannabis industry data on employment. The employment demand within the cannabis industry is projected to remain robust, fueled by the industry’s continued growth and the escalating acceptance of legal marijuana across different states.

Regional Performance

Diving deeper into the financials of the cannabis industry across different states, each state exhibits a unique regulatory framework and tax structure, significantly impacting the cannabis market’s economic conditions.

New Jersey:

- New Jersey levies a 6.625% sales tax on recreational marijuana, with medical cannabis sales being tax-free as of July 1, 2022.

New York and Missouri:

- New York and Connecticut have pioneered a potency-based tax per milligram of THC, contrasting with most states like Missouri, which impose an ad valorem tax on the retail sales price of cannabis.

Sales Figures (New Jersey & New York):

- The amalgam of medical and recreational sales for a specific period amounted to $182.4 million, marking a 2.6% ascent from the preceding quarter. This upward tick in sales revenue underscores a market in growth.

Taxation in New York:

- New York has instituted a 13% excise tax on cannabis sales (9% state and 4% local), with a potency-based tax remitted by distributors. The potency-based levy is 0.5 cents per milligram of THC in flower products and 0.8 cents per milligram of THC in other products.

Missouri:

- In Missouri, the constitutional amendment has green-lighted recreational weed sales, including a 6% statewide tax, and permitted local governments to charge a sales tax of up to 3% to cannabis consumers.

Michigan:

- Michigan imposes a 10% excise tax on cannabis, which amassed revenues of $31 million in 2020 and surged to $111 million in 2021. Additionally, a 6% sales tax is levied on both categories of cannabis, with an extra 10% excise tax on recreational marijuana sales. The revenue from cannabis sales in December alone amounted to $221.7 million, marking a year-over-year increase of 32%. The tax revenues are channeled among municipalities, counties, and the School Aid Fund for K-12 education.

California’s Market Size:

- California emerges as a colossal cannabis market, eclipsing Canada’s entire market size.

- The recreational cannabis market in California is projected to burgeon to 7.2 billion USD by 2024.22

These figures and regulations underline the varied tax structures states have adopted and the substantial revenues generated from these taxes. Moreover, the data emphasizes the rapid growth in sales, reflecting a thriving market spurred by increased acceptance and legalization of cannabis across these states.

Image by Maitane Romagosa for Thrillist

Cannabis Statistics Summary

The data and trends explored in this article underscore the cannabis industry’s substantial growth and its increasing influence on the economy and employment sector.

As legislative frameworks adapt to changing public attitudes, new economic conditions and employment opportunities emerge. The cannabis industry is creating a new market and contributing significantly to the US economy. The ongoing evolution of legal frameworks and market dynamics indicates a promising future for stakeholders, with cannabis industry statistics suggesting a bright trajectory. It also presents a potential avenue for further research and analysis in understanding the long-term impact of this industry on a greater scale.

- https://www.stash.com/learn/cannabis-industry-statistics/#:~:text=At%20the%20end%20of%202022%2C,Statista ↩︎

- https://www.grandviewresearch.com/industry-analysis/cannabis-cultivation-market ↩︎

- https://www.globenewswire.com/news-release/2023/09/11/2301091/0/en/U-S-Cannabis-Market-Growth-Trends-COVID-19-Impact-and-Forecasts-2021-2026.html ↩︎

- https://mjbizdaily.com/cannabis-industry-will-add-100-billion-to-us-economy-in-2023/#:~:text=The%20total%20U,the%20newly%20published%20MJBiz%20Factbook ↩︎

- https://www.researchandmarkets.com/reports/5766626/cannabis-cultivation-global-market-report#:~:text=The%20different%20sources%20include%20flowers,6 ↩︎

- https://alpharoot.com/cannabis-statistics-2023/#:~:text=The%20United%20States%20is%20the,pounds%20of%20cannabis%20per%20year ↩︎

- https://alpharoot.com/cannabis-statistics-2023/#:~:text=The%20United%20States%20is%20the,pounds%20of%20cannabis%20per%20year ↩︎

- https://www.researchandmarkets.com/reports/5766626/cannabis-cultivation-global-market-report#:~:text=The%20global%20cannabis%20cultivation%20market,least%20in%20the%20short%20term ↩︎

- https://www.leafly.com/news/industry/legal-cannabis-americas-most-valuable-crop ↩︎

- https://www.leafly.com/news/industry/how-much-weed-grown-us-2022 ↩︎

- https://www.grandviewresearch.com/press-release/global-cannabis-cultivation-market ↩︎

- https://www.statista.com/statistics/1108194/cannabis-cultivation-licenses-by-state-us/ ↩︎

- https://alpharoot.com/cannabis-statistics-2023/#:~:text=The%20average%20cannabis%20production%20area,2016%20to%2033%2C900%20in%202021.&text=In%202021%2C%20cultivators%20produced%20cannabis%20through%20indoor%20farming.&text=A%202021%20survey%20found%20that,growing%20facilities%20of%2080%2C000%20sq. ↩︎

- https://www.statista.com/statistics/1124538/tax-revenue-from-cannabis-sales-by-state-us/ ↩︎

- https://www.taxpolicycenter.org/publications/pros-and-cons-cannabis-taxes/full ↩︎

- https://bdsa.com/content/pricing-compression-in-an-evolving-cannabis-market-2/ ↩︎

- https://www.mpp.org/news/press/legalization-states-generated-more-than-$37-billion-from-legal-adult-use-cannabis-sales-in-2021/ ↩︎

- https://www.cannabisbenchmarks.com/reports/u-s-cannabis-spot-index-october-13-2023/ ↩︎

- https://cannabistraininguniversity.com/jobs/cannabis-employment-report-2022/#:~:text=As%20of%20January%202023%2C%20there,2023%202017%20%E2%80%93%20122%2C280%20jobs ↩︎

- https://www.leafly.com/news/industry/cannabis-jobs-report#:~:text=The%20US%20cannabis%20industry%20now,Open ↩︎

- https://vangst.com/reports/salary-guide ↩︎

- https://www.newswire.ca/news-releases/new-report-california-s-legal-cannabis-market-on-track-to-reach-3-1-billion-in-2019-sales-7-2-billion-in-2024-826839872.html ↩︎