My career in solar began in 2009, just after the U.S. housing market crash left the stock market and construction industry in shambles. I decided to leave my career in civil engineering in order to find a position in the newly budding industry of solar power, which was one of the fastest growing industries at the time and offered an opportunity for me to combine my passion for environmentalism with my love of technology.

I studied solar briefly in college and knew the basics but I was far from an expert in the field. In order to break into the industry, I took a position as a low-level engineer at a young solar startup. A year and a half later I’d become a knowledgeable solar engineer and I accepted a job at SunPower, a leading manufacturer of high-quality solar products.

Over the next 7 years I worked my way up through the ranks, eventually ending up as Director of Product Management, responsible for product strategy of a department worth $300 million in sales annually. At the end of 2017, I decided to leave the solar industry to pursue my dream of starting a cannabis tech company, again combining another of my passions, cannabis, with my love for technology.

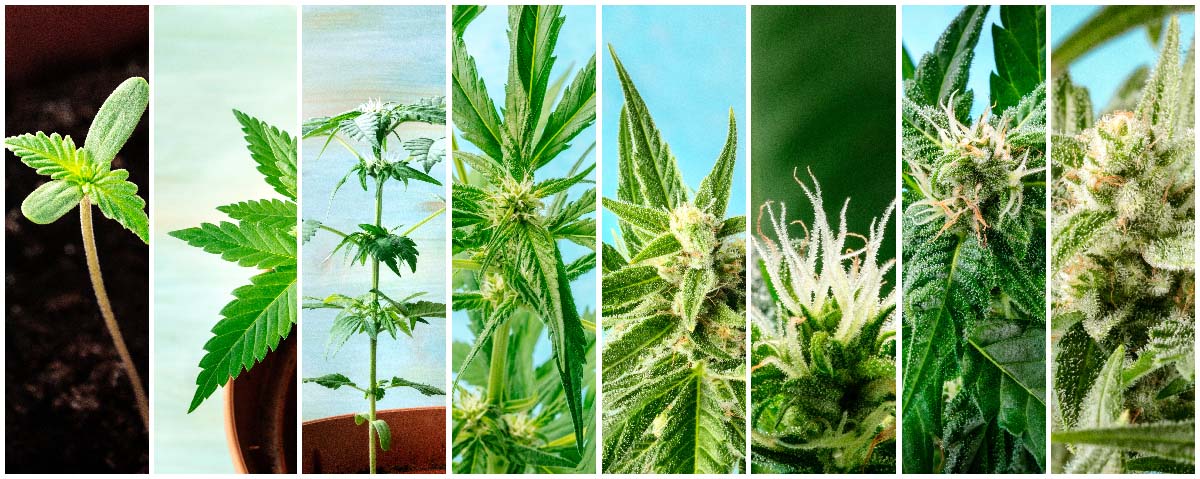

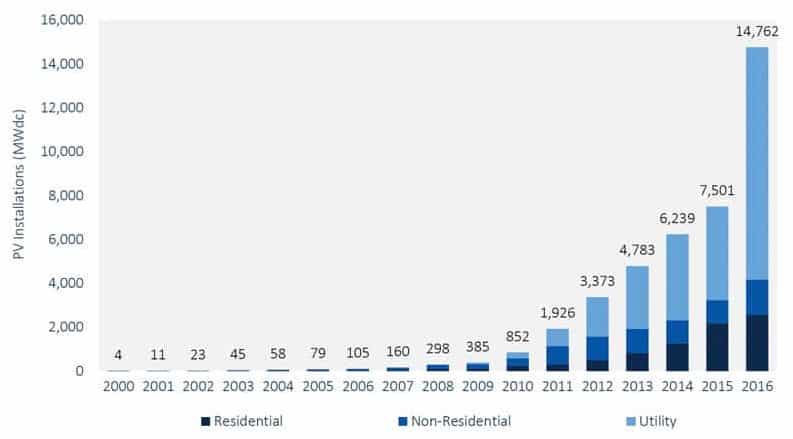

In co-founding Trym, I found that the cannabis industry is currently at a similar place in its evolution to where the solar industry was when I first joined. As can be seen in the graph below, the U.S. solar power market took off in 2009, and by 2017 it had grown 38 times the size from when I first joined.

The time spent in solar, combined with my recent experiences starting Trym, has given me a unique perspective into the similarities between the cannabis industry and the early days of the solar industry.

U.S. Annual Solar (PV) Capacity 2010-2016

Here are some similarities I’ve observed between the cannabis industry and the pre-mainstream solar industry and what to be aware of as the market continues to grow:

Projections of explosive growth

Legal cannabis has gained significant traction worldwide due to high demand among consumers as well as increasing legalization of cannabis in various states within the U.S. It’s impressive how far the industry has come since 1996, when California first legalized cannabis for medical use.

Now over 60% of Americans live in states where they can legally access cannabis and 25% live in states where they can purchase it for recreational use. These statistics are remarkable, which is why it’s hard to imagine that despite all of the growth the industry has experienced, it’s still just the beginning. The U.S. market is expected to quadruple over the next 8 years, with spending expected to exceed $47 billion by 2027.

Heavily regulated, segmented market made up of thousands of distributed small businesses

Similar to cannabis, the solar industry is an incredibly regulated industry. Each state and local jurisdiction has their own laws, regulatory bodies, and regional specific incentive programs. Because of these market conditions it was common, initially, for solar businesses to focus on specific regional markets, which led to a highly distributed market comprised of thousands of small businesses.

These same conditions exist in the cannabis industry today. Although the majority of states have legalized cannabis, interstate commerce is not possible due to federal prohibition and within each state there are unique regulations that must be understood and navigated. This is why even the largest brands in the cannabis industry are not present in every market and small to midsize businesses, distributed across the U.S., make up the lion-share of the industry.

If you build it, they will come

My first job in the solar industry was at a small startup where I was one of the first employees hired. This is a similar story shared by many pioneers in the early days of solar since the growth projections of the market led many from various other industries to flock to the solar industry. Some joined for a passion for the industry, some joined with aspirations of wealth, and some joined for a combination of both.

These startups had a period of time to thrive, but eventually, as more brands entered the space, competition increased in all areas of the market. Well-capitalized, large corporations that were capable of operating nationally or internationally began entering the market. Many of the small businesses that had helped form the industry began getting squeezed out. Similarly, growth projections of cannabis has drawn significant attention from the media, investors, and entrepreneurs. As with the early days of solar, the combination of capitalization and innovation has led to an onslaught of startups entering the space.

The result is that a multitude of companies are attempting to become the best at solving a relatively fixed number of problems that exist in the market. This increase in competition will undoubtedly result in some brands prevailing and others missing out. Additionally, when you factor in companies such as Microsoft, Anheuser Busch, and Monsanto circling the industry with intentions, or in some cases, demonstrated action, to enter the space, it creates a recipe for inevitable consolidation and unfortunately, expiration dates for some brands.

To sum things up, with nascent markets, change is the only constant. The opportunity that the growing cannabis market represents is one that everyone involved should appreciate but also not take for granted. Understand that the business you’re building or that you’re working for will look much different in the future. To remain successful you must ensure that your business is built to be nimble and adaptable.

Design your business objectives and plans with the best information that you have at the time, but recognize that with forecasting, you’re either lucky or you’re wrong, so be ready to revisit and tweak your plan regularly.