As we move into 2024, the cannabis industry continues its rapid evolution, shaped by technological advancements, regulatory changes, and shifting consumer preferences. This year promises to be a defining one for the industry, marked by the following cannabis trends and significant developments in various domains.

Rescheduling Cannabis on the Federal Level

2024 might witness a historic shift in the U.S. federal policy regarding cannabis. The Drug Enforcement Administration (DEA) is expected to approve the rescheduling of cannabis from Schedule I to Schedule III, following a recommendation by the U.S. Department of Health and Human Services. This move, long-awaited by industry stakeholders, could transform the legal and operational landscape of the cannabis industry, potentially easing restrictions on research, banking, and taxation.

However, it’s important to note that while the DEA is likely to follow through on the HHS recommendation, the exact timeline and the legal challenges that may ensue are unclear. Considering the political cycle, there’s a consensus that the DEA will sign off on this recommendation and issue a proposed rule change, potentially within 2024.

Challenges Arising from Rescheduling

The process will likely be subject to legal challenges that could arise from the rescheduling of cannabis at the federal level. These challenges involve various complex and interrelated issues like Regulatory and Compliance Adjustments.

If cannabis is reclassified to Schedule III of the federal Controlled Substances Act (CRS), it would require a significant overhaul of the regulatory framework. This would involve changes to regulations and guidelines by various federal agencies, such as the DEA and FDA, to adapt to the new scheduling. Such adjustments could pose legal challenges concerning interpreting and implementing these new regulations.

State vs. Federal Law Conflicts

It is important to note that despite the rescheduling of cannabis, conflicts between federal and state laws may continue to exist. The states that have legalized cannabis may encounter difficulties harmonizing their regulations with the changes made at the federal level. As a result, legal disputes over jurisdiction and enforcement may arise.

Business and Tax Implications

If cannabis were rescheduled to Schedule III, businesses would be allowed to deduct normal business expenses, unlike under the current federal code IRS 280E. While this will be a momentous milestone for operators in the industry, it could come with challenges like legal disputes as businesses and tax authorities adjust to the new landscape.

Convictions and Sentences

Rescheduling may lead to legal appeals and sentence reviews for individuals previously convicted or serving sentences for cannabis-related offenses under federal law.

Intellectual Property and Licensing

Rescheduling cannabis has the potential to facilitate more extensive research and development in this field. This could significantly increase patent applications and intellectual property disputes as companies and researchers compete for control over cannabis-related innovations.

Medical and Pharmaceutical Regulation

Moving cannabis to Schedule III would acknowledge its medical value, potentially leading to increased pharmaceutical interest and development. However, this could also lead to legal challenges around drug approval processes, marketing, and distribution.

Evolution of Substrate Sensors for Cultivation

The cultivation side of the industry is moving toward technological sophistication and efficiency. This trend reflects a larger shift towards automation, a necessary step for an industry grappling with high operational costs and labor-intensive processes.

Sensor manufacturers are leading the way in introducing hardware that significantly enhances the ability to monitor and optimize growing conditions. These sensors are becoming increasingly affordable and offer various options, allowing cultivators to monitor and optimize growing conditions more precisely. This trend is about technology and making advanced cultivation techniques more accessible to a broader range of growers, from small-scale operations to large commercial enterprises.

Aroya unveiled the TEROS ONE Substrate Sensor in 2023. This sensor collects substrate data by providing accurate readings in areas where traditional sensors fall short. It separates electrical conductivity (EC) measurements and water content, allowing for precise data collection even in high-salinity environments that typically challenge other sensors. This advancement is crucial for growers pushing the limits for maximum yield and quality, as it enables precise measurements critical for effective crop steering.

Growlink also unveiled its Terralink soil moisture sensor in 2023. Utilizing advanced capacitance technology, the Terralink sensor provides precise real-time measurements of soil moisture, electrical conductivity (EC), and temperature. At an affordable price point, Growlink is expanding access to crop steering hardware for cultivators and promoting precision-based practices.

These developments in substrate sensor technology are critical in an industry that faces high operational costs and labor-intensive processes. The increased precision and automation these sensors offer enable growers to make more informed decisions, leading to better resource allocation, reduced waste, and, ultimately, higher yields and quality. This technological renaissance in cannabis cultivation is not just about advanced tools; it’s a fundamental shift towards a more data-driven, efficient, and sustainable approach to cannabis farming.

Enhancement of Cultivation Analytics and Big Data Utilization:

The emergence of ‘big data’ has begun to play a transformative role in commercial cannabis cultivation. This new era is marked by a shift towards precision agriculture, where every aspect of growing is optimized through advanced technological insights. Integrating data-driven strategies encompasses many innovations, from the ground-level application of IoT devices to the strategic use of predictive analytics for risk management.

This evolution is not just enhancing the efficiency and yield of cannabis crops but also reshaping the entire cultivation landscape toward a more sustainable and scientifically informed future.

Data-Driven Cultivation Decisions

The adoption of data analytics in cultivation allows for precision farming. By analyzing real-time environmental data, growers can optimize conditions like lighting, humidity, and nutrients. This leads to healthier plants and enhanced yields. For instance, adjusting the lighting schedule based on plant growth stages can significantly improve growth rates and cannabinoid production.

Utilization of IoT Devices

Internet of Things (IoT) devices in cannabis cultivation are becoming commonplace. Sensors and connected devices collect vast amounts of data on various aspects of the growing environment, which can be analyzed to glean insights into plant growth patterns, resource usage, and potential areas for efficiency improvements.

This technology enables growers to maintain ideal growing conditions, improving plant health and resource efficiency. An example is using soil moisture sensors to optimize irrigation schedules, preventing over or under-watering.

Similarly, climate sensors in greenhouses can automate the control of temperature and humidity, helping to maintain ideal growing conditions.

Predictive Analytics for Risk Management

Predictive analytics helps foresee cultivation challenges, allowing growers to take preventive measures. This approach minimizes the risk of crop loss and improves plant health. Machine learning algorithms can analyze historical climate data to predict the likelihood of pest infestations or fungal diseases. This enables preemptive measures, like adjusting the microclimate or applying targeted treatments, to avoid potential issues.

Customized Cultivation Strategies

Data insights enable growers to tailor cultivation strategies to specific cannabis strains, optimizing their unique qualities. Data-driven adjustments in humidity levels or nutrient regimes can maximize the yield and quality of each strain, catering to specific market demands or medicinal properties.

For instance, data analysis can reveal that certain strains thrive at specific temperature and humidity levels, light spectra, or with certain nutrient regimes. In addition, the settings for these variables at different stages of growth require further fine-tuning. Adjusting these parameters can maximize the yield and potency of each strain. Cultivators can take things to the next level by monitoring, analyzing, and adjusting variables.

Supply Chain Optimization

Effective supply chain management, driven by data analytics, ensures that cultivation operations are aligned with market demand, reducing waste and improving profitability. This includes optimizing inventory levels, forecasting demand, and improving distribution logistics.

Big data analytics and market trend analysis can guide cultivation schedules, ensuring that production meets consumer demand and industry trends, thus optimizing the supply chain. Analyzing sales data can help forecast demand for specific cannabis products, which dictates the schedules and production plans.

Enhanced Research and Development

Big data plays a pivotal role in strain development and new cultivation techniques, fueling innovation in the industry. Genomic data analysis, for instance, can lead to the development of strains with desired characteristics, while research into growth patterns can yield more efficient cultivation techniques.

These advancements signify a shift towards a more technologically advanced, efficient, and responsive cannabis cultivation industry. Integrating big data and analytics optimizes the immediate cultivation process. It aligns with broader goals like sustainability, market adaptation, and continual innovation, setting a new standard for precision agriculture in the cannabis sector.

Looking Ahead

In 2024, the cannabis industry is gearing up for substantial changes, with three key trends at the forefront. First, the anticipated rescheduling of cannabis by federal authorities could ease constraints in areas like research and finance while introducing new legal and regulatory challenges. Second, technological advancements, especially in substrate sensor technology, are revolutionizing cannabis cultivation with enhanced precision and efficiency. Third, integrating big data and analytics transforms cultivation practices, promoting more informed decisions for sustainable and productive methods. As we look into 2024, these trends suggest a dynamic and evolving cannabis industry heavily influenced by technological innovation and regulatory changes.

Check out last year’s Trends to Watch in 2023

ECONOMIC DOWNTURN AND OPERATIONAL EFFICIENCY

In a recession, people tighten their wallets. The good news is that cannabis is a staple for households, whether used medically or recreationally. People may move across categories and price points, but their expenditures shouldn’t cease. Coupled with expanding markets in new states all over the country, there’s no doubt that there is still massive growth ahead for the cannabis industry.

A recession presents opportunities to reconfigure business operations to become more efficient. Every dollar counts and business owners are looking to cut extra fat wherever possible. Recessions will come and go with time, but commercial cannabis cultivators that want to stay in business will innovate and steer towards long-term growth.

Cannabis is a resource-intensive plant to grow, requiring a high amount of electricity, nutrients, startup costs, but most importantly labor, which makes up more than half of all operational costs.

Race to the Bottom

In more competitive, saturated markets like California, Colorado, Oregon and Michigan, prices are in a race to the bottom. There are various reasons causing the decline, but any strategic cultivator will want to reexamine their operation and identify any areas for cost improvement. If you can’t increase revenues, you can decrease costs.

Labor is the Key

Not all cannabis businesses have huge financial backings that can weather an economic downturn. Self-funded, or smaller operations, have a much smaller margin of error for their revenues and expenses. Large-scale, multi state operators must also seek cost savings and efficiencies. In all cases, labor is the greatest expense.

Labor is the largest expense in commercial cannabis cultivation, accounting for nearly 50% of production costs. Cannabis cultivation requires a skilled team to support the growing, maintenance, harvesting, and processing.

As the industry has matured, many businesses have taken on more production space and larger teams, making it more challenging to manage daily activities and maintain accountability. Increasing team efficiency by improving communication methods and streamlining daily activities can have a huge impact on your bottom line.

Here are some tips to boost labor efficiency:

- Set clearly defined goals and communicate them to the entire team. Employees need to know what they’re working towards and how to get there

- Develop standard operating procedures (SOPs) so tasks are understood clearly and performed consistently

- Ensure all employees receive quality training

- Use cannabis software to manage daily operations and schedule tasks. Software provides a lot of benefits such as productivity tracking and performance analytics.

Finally and perhaps most importantly, create incentives for great work. Everyone needs to be recognized for working hard. When you track employee productivity, you can reward those who excel and find opportunities for additional training to those who need help to succeed.

OBSESSION WITH HIGH THC

Cannabis consumers across the country are making a statement at the register. Cannabis with high THC potency is the big seller. Cultivators keep pushing the boundaries higher than anyone thought was possible in the past. Some even surpassing the 30% mark.

Perhaps it’s a psychological calculation of getting the most ‘bang for your buck’ or simply a lack of education around terpenes and how the terpene profile is equally as important as THC levels. Either way, consumers are opting for the strongest weed they can get.

Discrepancy Between Labs

Cultivators have caught on that there are large discrepancies between testing labs, when it comes to getting those high THC results. Higher % can sell for 60-80% more than cannabis that’s lower in THC content.

Some states have performed audits on their labs and shown that this in fact does exist on a wide scale. Many operators are pushing for a state lab that can establish standardized procedures, like those found in soil or water testing. The issue lies with how each lab prepares the sample for testing, mixing with different reagents or solvents, before going into the testing equipment. (source)

What does that mean for commercial cultivators in 2023? And how can your operation respond to the market dynamics to take advantage of this trend?

For one, cultivators need to adapt and that means giving the consumers what they want. For one, you may consider trying out all the labs in your area and selecting the most reputable with the best results. But second, and more importantly, is our next trend of 2023: to develop genetics and a brand that can compete and sell.

Genetics + Branding

The number of multi-state operators is increasing as brands who have developed a foothold in one market, seek to expand their reach to new regions. And these aren’t just the biggest players in the industry. Craft cultivator, DogHouse Cannabis, founded in Salem, Oregon, expanded operations to Michigan to capitalize on a fresh market with fewer developed brands in-state. We expect this trend to continue as new states pass legislation and begin cannabis sales.

Cultivators have to play the game and stay on top of the preferred strains in the market. Or better yet, one step ahead. Tastes and preferences change very frequently in this market, partly fueled by breeders’ constant production of new cannabis strains.

Growers who have access to a breeder or employee who can start an in-house program, would be wise to develop and name their own set of strains. When you’re the only producer of a certain strain, your competitive edge skyrockets.

Couple a unique genetic portfolio with a distinct brand, and you’ve got a winning combo to take you through the year ahead and beyond. Take these winter months as an opportunity to invest time and energy into branding and marketing. Download our Marketing Plan Template and either review what you already have to improve and update it, or work with your internal team to develop a well thought-out marketing strategy.

Conclusion: 2023 Cannabis Trends

As a software provider to cannabis businesses, we regularly speak with a diverse range of operators. From our first-hand conversations, the cannabis industry trends covered above are of great importance to cultivators across the US.

This new year will be monumental to widespread growth of the legal cannabis industry. Cannabis legalization across the country and beyond is increasingly the most important trend to watch and it’s only a matter of time until all the chips fall into place and federal legalization occurs.

See Last Years Cannabis Trends to Watch for in 2022

Review the cannabis industry trends and industry statistics we identified in 2022.

A focus on water conservation

Cannabis is a resource-intensive plant to grow, requiring a high amount of human labor, electricity, nutrients, and water. Efficient water management has become a popular topic this year as cultivators look for ways to reduce their water usage – especially in states like California which saw a near record-setting drought this year. In a report from the California Department of Water Resources, 2021 was the second driest year in state history.

With worsening drought conditions, it’s possible that regulatory water restrictions could impact commercial cultivars in the near future. Similar restrictions have been imposed around electrical power usage to lessen carbon emissions. Some operators see the writing on the wall and are taking steps to integrate water conservation practices.

“We’re building (production technologies) so we’re prepared, from both a fiduciary and a corporate responsibility standpoint, if there’s an issue with water use.” said Jigar Patel, co-founder and CEO, NorCal Cannabis. “But, more important, because we think it’s the right thing to do.”

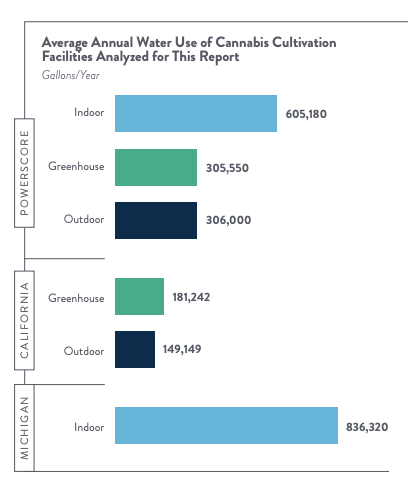

In 2021, New Frontier Data in partnership with Resource Innovation Institute published a report titled Cannabis H2O, Water Use & Sustainability in Cultivation. Data showed that on average, cultivation facilities use 121 gallons per square foot, per year. Indoor facilities averaged 209 gallons, compared to outdoor facilities averaging 11 gallons per square foot per year. The number of annual harvests is obviously significant in the cyclicality of water use, with multi-harvest facilities consuming increased volumes of water in a steady flow throughout the year. Outdoor facilities on the other hand, are likely to see their highest rates of use in late summer and early fall, as harvests approach.

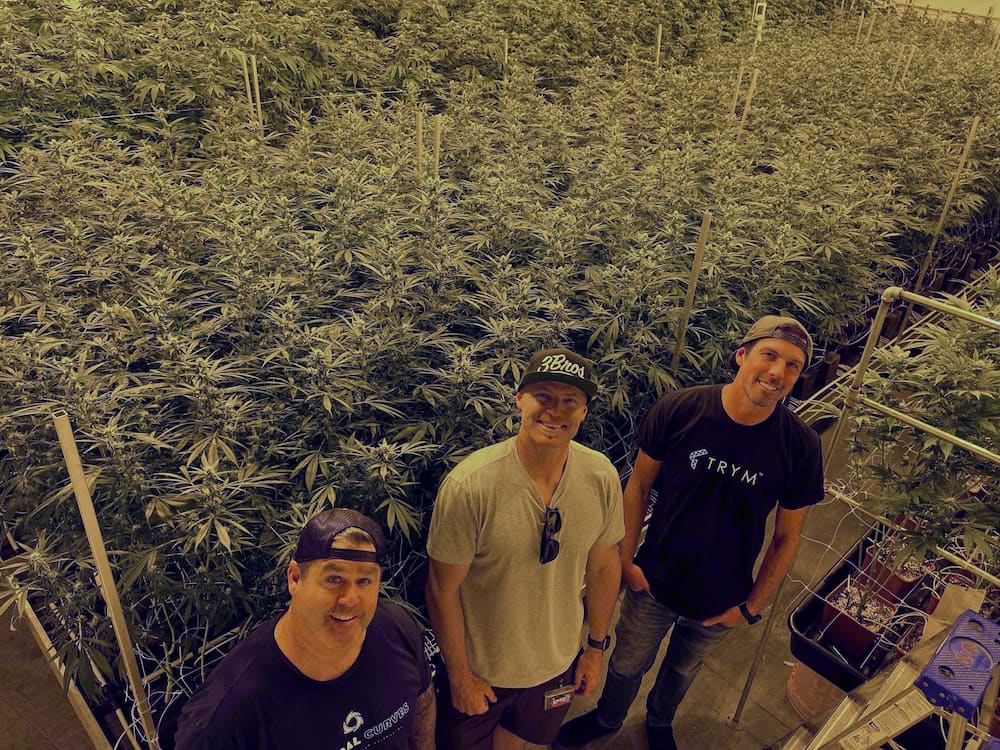

Crop steering – still all the rage

Crop steering made our list last year and it no doubt deserves to be here again in 2022. In the last year, we’ve seen a noticeable increase in the adoption of crop steering technology. More and more cannabis cultivators are deploying root zone and environmental sensors in their facilities to consistently track data points like EC, WC, humidity and CO2.

In tandem, there’s an increasing demand for crop steering information and guidance. Some businesses that have adopted crop steering methodologies and purchased the necessary technology are investing in consulting from experts to help them develop their own, tailored crop steering strategies.

In addition to crop steering tech and consulting, there’s been a wealth of new content published this past year to help growers learn about crop steering. We personally developed a guide with leading industry experts to spread the information and empower growers to take the leap. Our Growers Guide to Crop Steering has been downloaded by thousands of cultivators and we’re thrilled to support this next generation of indoor growing.

Emphasis on efficiency

Commercial cultivators have been focusing on production efficiency more and more in recent years. Efficiency has become especially critical as cannabis flower prices have dropped precipitously in some markets. Wholesale prices for outdoor flower dropped up to 60% in California in 2021 due to increased supply and production. Indoor growers were hit less hard by the market conditions, with prices decreasing by 10-20%.

Diminishing profit margins demands businesses cut operational costs and increase efficiency in order to remain profitable. In 2022, cultivators will continue to seek ways to better track and analyze their Cost of Goods Sold (COGS) in order to identify areas of improvement.

Brands are scaling to new markets

Amidst a global pandemic, supply chain issues, and the ongoing push to legalize cannabis at the Federal level, the cannabis industry continues to grow. As new markets explode with potential, established brands are scaling operations to these new states to replicate their success.

The average square footage of cannabis production areas has grown from 18,200 sq ft in 2016 to 36,300 sq ft in 2020, and the number of grow sites for cultivation operations has evolved from primarily single grow sites to multi-facility operations.

The number of multi-state operators is increasing as brands who have developed a foothold in one market, seek to expand their reach to new regions. And these aren’t just the biggest players in the industry. Craft cultivator, DogHouse Cannabis, founded in Salem, Oregon, expanded operations to Michigan this past year to capitalize on a fresh market with few developed brands in-state. We expect this trend to continue as new states pass legislation and begin cannabis sales.

More cannabis research and reports

What I find really exciting is the huge number of scientific papers published about cannabis this past year; over 3,800 reports were filed in the first 11 months of 2021. To put that in perspective, researchers published fewer than 3000 papers about cannabis between 1990-1999 and fewer than 2,000 papers were published in the ‘80s.

Increasingly, scientists, analysts, and industry experts are putting their time towards research and moving the industry forward. This activity signifies a huge shift in what we know about cannabis. This research adds legitimacy to our industry through data and scientific findings that helps break down stigmas and misconceptions about the plant. This should help bolster the case further to reschedule cannabis at the federal level.

CONCLUSION

As a software provider to cannabis businesses, we regularly speak with a diverse range of operators. From our first-hand conversations, the cannabis industry trends covered above are of great importance to cannabis cultivators across the US.

This new year will be monumental to widespread growth of the legal cannabis industry. Cannabis legalization across the country and beyond is increasingly the most important trend to watch and its only a matter of time until the chips fall into place.

CHECKOUT OUR ARTICLE ON MARIJUANA TRENDS FOR 2021

Review the cannabis industry trends and industry statistics we identified in 2021.

CROP STEERING TAKING INDOOR CULTIVATION BY STORM

One thing you can always count on from the cannabis industry is innovation. The hottest trend in indoor cultivation right now is by far Crop Steering, as featured in our recent blog article. This technique has been adapted for cannabis to optimize production yields by manipulating grow conditions and feedings to ‘steer’ plants into vegetative or generative growth.

The goal in commercial cannabis production is to maximize yields by optimizing plant growth in each stage. With crop steering, plants are given the opportunity to produce only enough foliage and stems in vegetative growth to support vigorous flower production.

Crop steering can be done at any stage of growth to accomplish specific goals a grower might have. In the last few years, crop steering techniques have really taken off at indoor cultivation facilities. Growers have been exploring a mix of vegetive and generative steering throughout the cannabis flowering cycle to maintain plant balance.

Crop registration is the collection of detailed measurements and is arguably the most important aspect of crop steering. Through diligent data collection, growers can track how their steering actions affect the plants and resulting yields. Since there is little information for growers on this topic online, we developed a guide to crop steering with the help of leading industry experts. To dive into this subject and start steering at your facility, download our free guide here.

INCREASING BENCHMARKS FOR THC

At the top of our cannabis industry trends list is the race to the highest THC %. There’s an interesting two-way communication between producers and marijuana consumers in the legal marijuana market. Breeders and growers define what cultivars they choose to grow each year. And consumers vote with their dollars to signal back to brands, distributors and cultivators what strains they prefer.

What we’ve been seeing over the last few years, is an increasing demand for high THC strains. While we’re learning more about how the present terpenes in a strain might play a more important role in the effect or ‘high’, consumers consider their options in a simple way: highest THC for lowest $.

Cultivators have to play the game and stay on top of the preferred strains in the market. Or better yet, one step ahead. Tastes and preferences change very frequently in this market, partly fueled by breeders constant production of new cannabis strains.

Growers who have access to a breeder or employee who can start a program, would be wise to develop and name their own strains. When you’re the only producer of a certain strain, your competitive edge improves.

THE DOMINO EFFECT OF CANNABIS LEGALIZATION

We’re way past the 50% tipping point for United States cannabis legalization. Today, 36 states and 4 territories have some level of cannabis regulations in place. November 2020 elections added New Jersey, Arizona, South Dakota, and Montana to the roster.

What to watch for in 2021? Two very large, legal marijuana markets are likely to be brought online: New York and Texas.

New York has really felt the economic impact of Covid-19 this year. And it seeks to use cannabis tax revenues to assist in economic recovery. The state is projecting to go live in April of 2021. Governor Andrew Cuomo, asked the legislature to include a measure in the January budget to enact cannabis state law.

With New Jersey and Pennsylvania both facilitating legal cannabis, New York finds itself in a legal cannabis sandwich, and it doesn’t want to miss out. The East coast is turning on quickly.

We’d love to see novel agreements between these densely packed, neighboring states. A reciprocity of some sort, or potentially some kind of trade bubble across state lines. That would set a precedent for the rest of the country and set a route for federal cannabis legalization and inter-state trade.

Texas is another state whose total potential market is huge. SB 140 bill filed on November 9, 2020, seeks to legalize cannabis and establish a commercial cannabis industry in the state. Legal marijuana could produce more than $1.1 billion in Texas state tax revenues.

CANNABIS BUSINESS DURING COVID-19

Covid-19 has impacted every soul on this globe, in one way or another. Luckily for cannabis operators in the US, this industry was deemed Essential. This allowed cannabis businesses to stay operational while many other industries had to shut down.

Mandated changes to how marijuana businesses operate in this new world were introduced. Winter is upon us and so is an increase in Covid cases. More lockdowns and restrictions are coming, but cannabis operators are addressing the new requirements.

Most retailers who weren’t previously delivering are most definitely doing it now. At the least they’re offering drive through or curbside pick up transactions to support their retail sales. In-store shopping is no longer the same. Social distancing is mandated and display cases and shields everywhere make it more difficult for consumers to evaluate cannabis products.

This makes it extremely important to ensure your product listing on a cannabis delivery site or online dispensary stands out visually and provides all the information a marijuana consumer is seeking. High-resolution photography, cannabis product description, and ingredients or cannabinoid profiles should be highlighted. Cannabis retail sales are more determined by marketing than at any other time in the past.

Cultivators with brands in the marketplace would also be wise to think about point of sale promotional materials to help communicate their legal marijuana brand’s unique selling points to potential customers.

ACCESS TO BANKING MORE IMPORTANT THAN EVER

All eyes are on the United States Senate this coming year. Many believe they will finally pass legislation to grant legal cannabis businesses access to banking and financing services. The cannabis industry’s ‘Essential’ designation is ironic when many have to lug around bags of cash, putting them into vulnerable and dangerous situations.

Opening up banking services alone will make a huge impact on the legal marijuana industry as a whole. Investment would flow in more, valuations might increase, and most importantly, marijuana business transactions will become much easier.

A cannabis company could seek bridge loans from the bank rather than taking hard money loans which come at increased risk and high interest rates. In the expanding legal marijuana industry, scaling is important to maintain market share. But scaling requires an injection of money that operators may not have.

The ability to turn to banks for traditional financing would help organizations of all sizes grow their business in the legal marijuana industry.

In October 2019, the United States House of Representatives passed a landmark cannabis banking bill called the SAFE Banking Act. This legislation would indemnify banks from federal prosecution for working with cannabis companies.

However in early 2020, the senate version of the bill was held up and then Covid-19 hit. The SAFE Banking Act has the best chance of any federal government proposals of becoming law in 2021, even though the Senate is likely to block most democratic initiatives heading its way. Banking-focused legislation has significant bipartisan support and we hope to see movement in the Senate in 2021.

In California, the nation’s oldest regulated cannabis market, Assembly Bill 1525 was passed in October encouraging banks in the state to do business with cannabis businesses. Although banks still have to report to the federal agency FINCEN, this lays the groundwork.

“The goal of AB 1525 is to make it easier for financial institutions to adhere to federal law reporting requirements. Now, it will be easier to be assessed for loans and other services.” (Harris Bricken)

CANNABIS INDUSTRY STATISTICS

New Jersey, Arizona, South Dakota, and Montana became the newest states to legalize marijuana. This addition raised the total number of states with recreational cannabis use from 11 to 15 states and 3 territories.

In total, 36 states and 4 territories (District of Columbia, Guam, Puerto Rico and U.S. Virgin Islands) have enacted measures in the medical marijuana industry. (source)

The market value of the U.S. cannabis industry is projected to reach $30 billion annually by 2025, according to industry research group New Frontier Data. This projection comes at a time when cannabis remains federally illegal despite state legalization of medical marijuana by 33 states and Washington, D.C., and the legalization of adult-use cannabis (often referred to as recreational marijuana use) programs by 11 states and Washington, D.C.

The compound annual growth rate (22%) of the cannabis industry continues to defy expectations every year. Cannabis consumers across the country are showing incredible support for legal marijuana in new markets and old. The stigma is fading away slowly but surely as cannabis sales skyrocket. Medical marijuana regulations are the first steps for some states to open up to fully legalizing marijuana for all adults.

The CBD market in the US faces less regulation than the THC market, which is regulated state by state. Since the passage of the 2018 Farm Bill, the hemp industry has taken off – CBD products are found in many brick and mortar stores as well as in online stores. Brightfield Group has released a report forecasting CBD market total sales to reach $12.4 billion by 2023 and $16.8 billion by 2025. The CBD industry around the world is exploding as well as inter-country trade is active.